New maternity supplement in pensions: from the first child, in a single installment and also for men

Susana Zamora

A judgment of the Court of Justice of the European Union (CJEU), issued on December 12, 2019, marks a turning point in Spanish legislation. That day he pronounced against article 60 of the General Social Security Law (in force since 2016), because it violated European Directive 79/7 and constituted "direct discrimination on the basis of sex". And it is that said rule only contemplated a maternity supplement with respect to women who, having had two or more biological or adopted children, were entitled to a contributory retirement pension, permanent disability or widowhood in any regime of the Social Security system.

The European Court argued that the fact that women are more affected by the professional disadvantages derived from childcare, "because in general they assume this task, cannot exclude the possibility of comparing their situation with that of a man who assumes such care and that, for that reason, he may have suffered the same disadvantages in his professional career'.

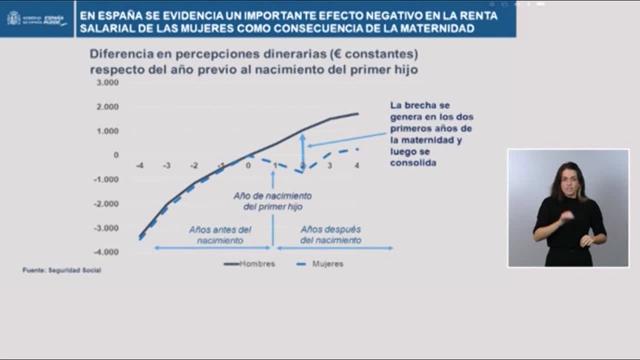

Such arguments served to fail the aforementioned sentence and a few days after the decision, retired Spaniards since 2016 began to request the maternity supplement, and when the National Social Security Institute denied it, they went to court. Since then, multiple rulings (one of the last in Malaga) have granted several parents the right to receive this bonus and the Ministry of Inclusion, Social Security and Migration has been forced to find a formula that continues to provide a plus in their retirement. to women who have seen their contribution career affected by the birth and care of children, but without prejudice to men, who will also be able to benefit from this supplement without having to go to court after the approval of the Royal Decree-Law 3/2021, of February 2, which adopts measures to reduce the gender gap and other matters in the fields of Social Security and economics, which entered into force on February 4, 2021.

Who is entitled to receive the new child supplement?

While previously only mothers of two or more children could request it, now those who have had only one can also request it. They will be granted by default, while men will have to expressly request it and must meet certain requirements:

- His retirement pension must be less than the one received by the mother.

- Parents of children born or adopted before December 31, 1994 must present contribution gaps of at least four months between the nine prior to the birth or adoption and the three following years.

- For parents of children born or adopted since January 1, 1995, the sum of the contribution bases for the two years following the birth or adoption must be more than 15% less than the sum of the two previous years.

In no case can both parents obtain the supplement and if both were entitled, it would only be awarded to the mother if it is a heterosexual couple and to the one who receives the lowest pension if it is made up of people of the same sex.

In what cases can parents request it?

In order for a man to apply, one of the following requirements must be met:

-Cause a widow's pension due to the death of the other parent for the sons or daughters in common, provided that one of them is entitled to receive an orphan's pension

-Cause a contributory retirement pension or permanent disability and have interrupted or affected their professional career due to birth or adoption, with certain conditions related to the contribution.

What is the amount of the new supplement per child?

Here is the other big difference from the previous norm. If until now the supplement was a plus calculated from the pension of each beneficiary (5% if you had two children, 10% with three and 15% from four), now a specific amount of 378 euros per year per child up to a maximum of four.

In other words, regardless of the retirement pension received, the supplement is always established between 378 and 1,512 euros per year. Or what is the same, 27 euros more in each of the 14 payments if you only have one child; 54 if you have two; 81 are are three; and 108 euros if there have been four or more offspring.

With this criterion, since it is a fixed amount and not a percentage, the new supplement benefits women with low pensions and harms those with higher pensions. Therefore, the list of pensioners who gain from the change is headed by men who meet the requirements to apply for the supplement, as well as by mothers of only one child. And it is that both cases did not receive anything with the previous norm.

However, with the reform, as the pension increases, the amount that is not collected is also greater. For example, someone who has a pension of 1,500 euros goes from earning 150 euros to earning 81 euros if she has two children, and drops from 225 euros to 108 if she has three offspring.

Is it for all pensions or just ordinary retirement?

It is for contributory pensions, permanent disability, widowhood or retirement (early or not), recognized as of February 4, 2021, but not for partial retirement, although you will be entitled to the supplement when you access partial retirement. to full retirement once the corresponding age has been reached in each case.

What requirements must be met to receive this supplement, in addition to having children?

-Be attached to any scheme of the Social Security system and apply for a contributory pension for retirement, permanent disability or widowhood. In other words, the supplement will be added to retirement pensions, voluntary early retirement, permanent disability and widowhood.

-The supplements that could be recognized in any of the Social Security regimes will be incompatible with each other. It will be paid in the scheme in which the pensioner has more periods of discharge.

-Children, born alive or adopted, must be registered in the Civil Registry.

What happens to pensions that already have the previous maternity supplement?

These pensions will continue to receive the maternity supplement. However, those men who have retired between January 1, 2016 (date on which the maternity supplement came into force) and February 4, 2021 (day on which its reform came into force) may continue to claim this bonus. before the Social Security and, if it is denied, before the courts, where the majority are handing down favorable sentences invoking the European doctrine.

How long will this plugin be paid for?

The right to recognition of the contributory pension supplement will be maintained as long as the gender gap in retirement pensions, caused in the previous year, is greater than 5%.

INSS, Ministry of Employment and Social Security, Pensions, Retirement, Pensioners, RetireesTrends