Social Security | How much do freelancers have to pay?

Patricia Carcedo

Self-employed workers have the obligation to register in the Special Regime for the Self-Employed (RETA) and the obligation to pay a monthly fee to Social Security. However, not all freelancers pay the same, but this fee is established depending on several factors, such as their economic activity. In fact, the increase in the Minimum Interprofessional Salary (SMI) in September has caused an increase in the share of self-employed workers of 0.3%. Therefore, to calculate how much a self-employed worker must pay, you have to look at a series of questions.

This monthly payment is translated as the contribution of the self-employed worker to be able to enjoy health care, leave such as maternity or paternity or temporary disability. This settlement of the fee is made at the end of the month to the administration of the Social Security Treasury (TGSS) through direct debit or from the agency's website.

If the self-employed cannot register at the beginning of the month, the amount will be calculated proportionally to the days that they are registered, as in the case of cancellation.

Calculation of the amount of the self-employed quota

The contribution base in the RETA can be chosen as long as it is within the minimum and maximum base established by the Government each year through the General State Budgets. The amount is a percentage that is calculated on the estimate of the contribution base or 'theoretical salary' as a worker. If the minimum amount is paid, the benefits will also be and the amount to be received for cessation of activity will vary. For example, in case of low, they will charge less.

What benefits and help do the self-employed have to buy a car

Patxi Fernandez/ MadridIn 2020 there was an increase in the contribution rate, later than usual due to the pandemic. At the beginning of 2021, its application was delayed according to Royal Decree Law 2/2021, given the delicate moment that the group was going through. The planned increase was conditioned until an improvement in the situation and the increase in the Minimum Interprofessional Salary (SMI).

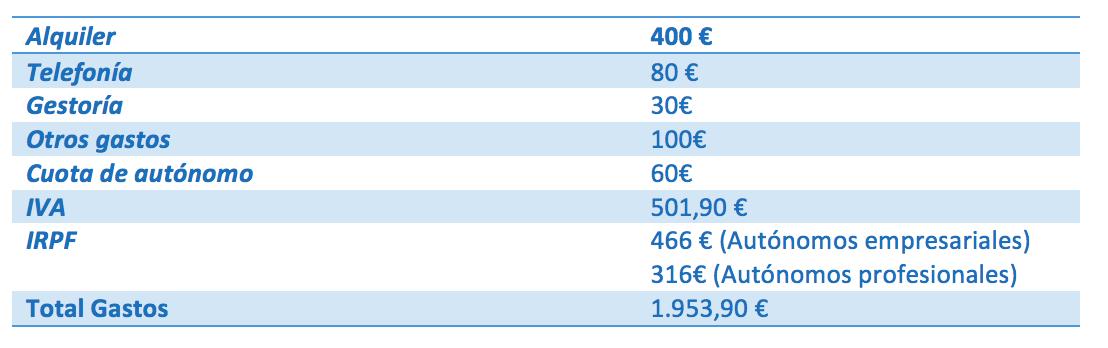

In September, the increase in the SMI was fixed, and the fee rose by 0.3%, 3 euros more for those who decide to contribute the minimum. This is due to an increase in the contribution rate for professional contingencies, which would go from the current 1.1% to 1.3%. And the percentage for cessation of activity, which rises from 0.8% to 0.9%. The amounts are then as follows:

The self-employed must not only present VAT in October: there are more tax obligations this month

El Comercio/ GijonIf quoted for the minimum base: 289 euros per month.

If quoted for the maximum base: 1,245.45 euros per month.

More news

The self-employed would have to pay up to 55% of their income to the State

Lucia PalaciosHalf of the self-employed who have not recovered their activity fear closures

Jose Maria WaiterFlat rate of 60 euros per month

The flat rate for the self-employed consists of starting with a monthly payment of 60 euros to Social Security instead of 289 euros, the minimum fee set in 2021 after the increase. The increase, in this case, does not affect it as it is a fixed amount that was already modified in 2019 when the payment was 50 euros.

Although it is called the 'flat rate of 60 euros', this contribution is the initial one. It applies to the first 12 months, after which there are reductions based on the base and the minimum contribution rate. A different reduction percentage is applied to each section depending on the time and age of the self-employed person.

More than 600 euros of fine for breaching the new Treasury regulation

The duration will be a maximum of 24 months, less for those under 30 years of age and women over 35, which is extended to 36 months.

Section 1: first 12 months. 60 euros per month are paid (reduction of 80%)

Section 2: months 13 to 18. 50% reduction on the base fee

Section 3: 19-21 months. 30% reduction on the base fee

Section 4: months 22 to 24. Bonus of 30%

Section 5: months 25 to 36. Additional bonus of 30% of the quota for those under 30 years of age and women under 35.

Imserso updates the amount of pensions of those who have never contributed

El Comercio/ GijonAlthough differences are made between reduction and bonus, in practice the difference between the two concepts is only found in the body that is responsible for the bonus payment. In other words, Social Security is responsible for the reductions and, in the case of bonuses, the Public Employment Service (SEPE).

The requirements to access this type of rate are the following:

- Be the first time you are registered as self-employed.

The changes in pensions that will come with the reform in 2022

El Comercio/ Gijon- Not having been registered as a self-employed worker in the last two years (three in case you have previously enjoyed a bonus).

- If at some point the flat rate has already been obtained, at least three years must pass since its cancellation. That is, you can apply again leaving 3 years in between

- Not being a self-employed collaborator (special regime for relatives of the self-employed).

Cessation of activity: all aid

The Government approved the new extension of the aid for cessation of activity in the Council of Ministers, after reaching an agreement with the representative organizations of the self-employed. It was possible to continue with the four modes of provision that currently exist and a new one was added. The request was made by the National Federation of Associations of Self-Employed Workers (ATA) addressed to employed workers affected by the situation in La Palma after the eruption of the volcano.

In addition to the fifth added benefit, two are maintained to cover the self-employed who expect a drop in income, another for cases of business closure by the health authorities and the last one to cover seasonal self-employed workers.

The early retirements that will benefit the most from the new pension reform

El Comercio/ GijonIn addition, an exemption in quotas is reactivated until January, which will decrease month by month and will cover self-employed workers who, having received the cessation of activity until September, do not request the rest of the benefits.

The deadline to request the cessation of activity, if you want to collect the entire month retroactively, is October 21. If the request is made after this period, the benefit will be received in November.

Federated Associations of Self-Employed of Asturias, Ministry of Employment and Social SecurityTrends